Learn With Experts

Triyash Training Academy

Goal is to Empower You Through Financial Literacy, as we all know, Knowledge is Power. Join our exclusive workshops, webinars, and video tutorials to learn:

Our Course Content

Course 1

Options Advance Training

Topics Covered

- Understanding Option Basics

- What is it & why is it Important

- Greeks

- Delta

- Gamma

- Long and Short Gamma

- Vega

- Theta

- Volatility

- Call Generation

- Co-relation

- Time Schedule

- Insurance

- Techniques for data maintenance

Toolkit includes Volatility Sheet, Gamma Sheet, and 3 established strategies which we deploy in Live Markets.

• Course Duration: 16-20 days

• Live Market Trading: 5-10 days

• Hand Holding: 1 month (Trading Guidance)

Course 2

Technical and Fundamental Analysis.

Topics Covered

- Understanding Share Market

- What is it & why is it Important?

- Introduction to Stock Market

- Dow Theory

- Types of Candlesticks

- Support/Resistance

- Gaps

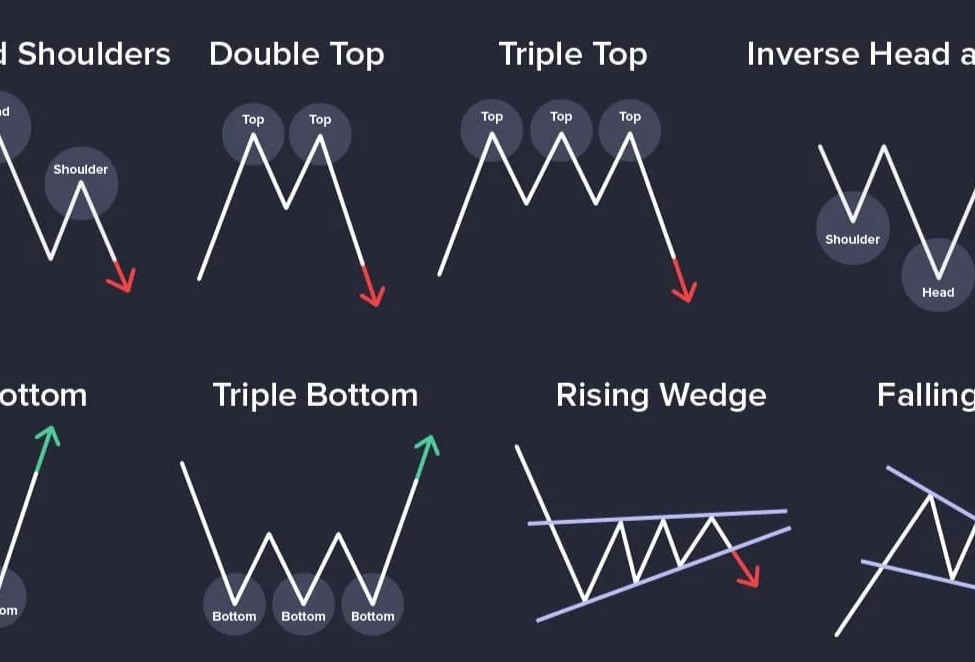

- 15 Chart Pattern

- 4 Indicators

- Golden Rules

- Fibonacci

- Basics of Derivatives Market

- 4 proven strategies which we deploy in live market

- Key parameters to look for in Fundamental Analysis

- Risk Management and Position Sizing Excel

- Tool Kit

• Course Duration: 16-20 days

• Live Market Trading: 5-10 days

• Hand Holding: 1 month (Trading Guidance)

What You will learn along us

Basics of Investing

how stocks, mutual funds, and other assets work, along with risk management and how to start building your investment portfolio confidently.

Market Trends & Analysis

Understand how to read market movements, charts, and news to identify opportunities, spot patterns, and make informed buying or selling decisions.

Wealth Creation Strategies

Discover long-term strategies like compounding, diversification, and goal-based investing to grow your wealth consistently and achieve financial freedom over time.

Budgeting & Debt Management

Learn to create effective budgets, track spending, reduce debt smartly, and manage your money better to improve savings and financial health.

Options Advance Training

Learn how to trade options like calls and puts, manage risk, and use strategies like hedging and spreads to boost profits in volatile markets.

Technical and Fundamental Analysis

Master chart reading, price patterns, indicators, and trend lines to predict market movements and make smart, timing-based trading decisions with precision.

From beginner to investor—your journey starts here as We believe -Invest in your knowledge before you do any financial investments in your life. with expert guidance and real insights we are here for you!

Have Any Questions?

FAQ's

Find quick answers to common queries about courses, investing basics, and how to start your stock market journey with us.

How to open a DEMAT Account?

What are the features & benefits of opening a DEMAT Account?

What are the documents required for a DEMAT Account?

Identity Proof: A copy of your PAN Card.

Address Proof: You may submit any one of the documents listed below.

• Voter’s ID

• Driver’s License

• Passport

• Aadhaar Card

Income Proof: You must submit

• A copy of your passbook

• Bank account statements for the last 6 months

• Latest salary slips

• Filed Income tax returns

What is the difference between DEMAT & trading accounts?

What are the documents required to open a trading account?

• Proof of Identity: PAN card/Aadhaar Card/Passport/Voter ID/Driver’s License

• Proof of Address: Utility Bills (Telephone, Electricity, etc.)/Ration Card/ Aadhaar Card/Passport/Voter ID/Driver’s License.

• Bank Details: Cancelled cheque/Copy of Bank passbook.

• Proof of Income: Copy of ITR/Account Statement for the last 3 months/Salary slips

What is IPO, and how to invest in IPO in India?

• Open a DEMAT account and a trading account linked to your bank account. Log in to your trading account and visit the section on IPO subscription.

• Select the investor type and enter the company’s name whose IPO you would like to subscribe to.

• Enter the number of shares you would like to purchase and input your bid price.

• Select your mode of payment and complete the transaction.

• The allotted IPO shares will be credited to the DEMAT account. If you do not get the IPO allotment, your money is refunded in the source account.

How to invest in Mutual funds?

How to invest in SIP?

How to start investing in stock market?

What basics of share market investment should I be aware of before investing?

• You will need to open a DEMAT and Trading Account with a SEBI-recognised broker

• You must consider your risk profile, investment goals, and preferred investment tenures before you begin investing.

• You must familiarise yourself with the basic stock market jargon, the various exchanges, and trading platforms.

• You must review the costs associated with share market investments

• You must avoid putting all your eggs in one basket, and instead diversify your investments.